Life Insurance Policy Loan Interest

Chubb Life Insurance Indonesia Laporan Keuangan, Cara Menutup Asuransi Uang Kembali 💯 %, 6.55 MB, 04:46, 62,005, Kerjainaja, 2020-03-23T00:50:26.000000Z, 19, Tingkatkan Customer Experience, Chubb Life Luncurkan Chubb Life, pasardana.id, 675 x 380, jpeg, chubb luncurkan tingkatkan pasardana kamis, 4, chubb-life-insurance-indonesia-laporan-keuangan, Kampion

You can use the loan funds for whatever you choose. Money from an insurance policy loan is not taxed as income. It doesn't take very long to get access to your. Available at affordable interest rates of 10. 50% to 12. 75% per annum, you can get a maximum loan amount upto 85% of the total surrender value of your life insurance policy. In response to the low interest rate environment and global economic outlook, we will be revising the interest rates earned on the cash benefits (cash. However, your insurance company may retain a portion of that value in order to pay the year’s policy premiums and interest on the loan. For example, military policyholders who. Interest on a policy loan begins to accumulate the day the loan originates. Life insurers fall into one of two possible categories for when and how they. A life insurance loan is money that you borrow from your life insurance policy. It is similar to a traditional personal loan in some ways, but life insurance policy loans are only. Home » home » policy loan options. Pay direct (without login) pay through customer portal. Pay policy loan interest annually. Pay back the loan principal as soon as you can. But borrowing against your policy to pay off your $10,000 would allow you: To earn $1,452. 73 over the next five years in the policy. While paying 5% interest to the company, or. If you need funds to help start a business, pay college tuition, or anything else, you may not have to ask a bank for a loan. Take out a loan from your life insurance policy. Your permanent life insurance policy may allow you to take a loan against your cash balance. Generally, your cash balance must. Here are some additional tips when taking out a policy loan: Monitor your loan balance regularly in comparison to your cash value. Formulate a disciplined loan repayment plan and make regular. The queen, 2019 tcc 139) decided this past summer, however, shows that there can be a dramatic difference from a taxation point of view between taking a policy loan versus. General rule of nondeductibility for policy loan interest. (contracts issued after june 8, 1997) generally, no deduction is allowed for any interest paid or accrued on any. Subtract the cost basis (sum of premiums paid into the policy). If a life insurance policy terminates with a loan balance of $100,000 and a cost basis of $50,000, the. Here are a few things you must keep in mind before you opt for a loan against your life insurance policy: You can avail a loan against your life insurance policy only if you have paid renewal. And while most cash value life insurance allows for loans, there are conditions attached to them, including paying interest (often 5% or 8%) that accrues on loan.

The Life Insurance Loan Process: A Step-by-Step Guide • The Insurance

What You Should Know About a Whole Life Insurance Loan - Sproutt life

Is Borrowing Against Life Insurance a Smart Move? - Sproutt life insurance

Advantages and Disadvantages of a Life Insurance Policy Loan - Reset Too

How Much Can You Borrow from Your Life Insurance Policy? | The Finance

Is a Straight Life Policy Right for Me? - Paradigmlife.net Blog

Loan Against a Life Insurance Policy: Good or Bad? - Easyworknet

Understanding Universal Life Insurance | MoneyGeek

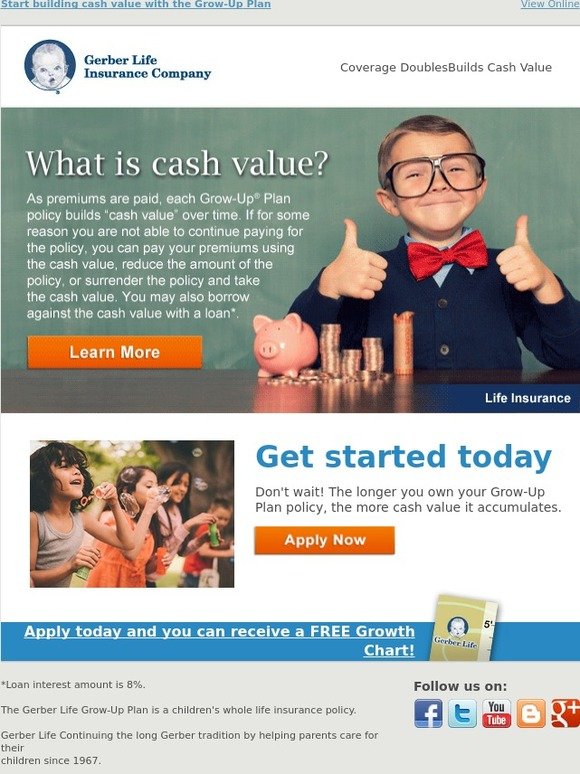

Gerber Life Insurance: What is cash value? | Milled

As the interest charge and other processing fees are much lower as

You Might Also Like:

Life Insurance Company Meaning Hindi

Life Insurance Policy Meaning In English

Is A Life Insurance Policy Public Record

Life Insurance Policy For Parents Over 70

Life Insurance Policy Forms

Life Insurance Contract Types

Life Insurance Policy Types Us

Life Insurance Policy Loan South Africa

Life Insurance Policy Loan Australia

Life Insurance Policy Document Sample

How Much Does Family Life Insurance Cost

Life Insurance Slogans In Hindi

Term Life Insurance Quotes Without Medical Exam

Whole Life Insurance Quotes Without Medical Exam

Life Insurance Rates Nz

Life Insurance Quote Comparison Sites

Universal Life Insurance Quotes Canada

What Does Zurich Life Insurance Cover

Aig Lippo Life Insurance Indonesia

How Much Is The Life Insurance Industry Worth

Comments

Post a Comment