Life Insurance Policy With Cash Surrender Value

Chubb Life Insurance Indonesia Laporan Keuangan, Cara Menutup Asuransi Uang Kembali 💯 %, 6.55 MB, 04:46, 62,005, Kerjainaja, 2020-03-23T00:50:26.000000Z, 19, Tingkatkan Customer Experience, Chubb Life Luncurkan Chubb Life, pasardana.id, 675 x 380, jpeg, chubb luncurkan tingkatkan pasardana kamis, 4, chubb-life-insurance-indonesia-laporan-keuangan, Kampion

Cash surrender value is the amount left over after fees when you cancel a permanent life insurance policy (or annuity). Not all types of life insurance provide cash value. A surrender fee of $300; And, current cash value of $3,500. The policy’s current cash value of $3,500 is the amount built over time by the accumulation of 30% of the premiums. Your cash value is now worth $13,000, and you decide to surrender your policy. You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. Typically, there are two types of surrender values in a life insurance policy. As the name suggests, this is the guaranteed amount of money. Essentially, you can get a rough estimate of your life insurance policy’s cash value by multiplying your monthly insurance payment by the number of months you’ve paid for your. The cash surrender value of a life insurance policy is the remaining amount of cash value that you get after you surrender the policy and repay all outstanding fees and loans. This fee means if you tried to cancel your policy after 10 years and withdraw your cash value, the insurance provider will assess a $3,500 charge to your cash value, leaving you. The cash surrender value is the amount of money an insurer will pay you if you surrender a permanent life insurance policy that has a cash value. Typically, the amount of. The cash surrender value is what you’ll get from the insurance company if you end your policy. Learn about why this matters. If you’re a viable. The cash surrender value is the sum of money an insurance company pays to the policyholder or annuity holder in the event his policy is voluntarily. Term life insurance policies don't accumulate cash value like whole or universal policies. Therefore, they don't have a surrender cash value either. You can surrender your term. You decide to surrender the policy for cash value. Once the insurance company adjusts their surrender fee of 20%, you will receive $4,800. The company will keep the. Prudential custom premier ii, a variable universal life insurance policy, in its illustration, would allow her to withdraw $19,710 from the policy from year 19th (55 years old) to. Cash surrender value is the. When a life insurance policy has a cash surrender value, it means that the policyholder has the option to cash out the policy for its current cash value. Cash surrender value in life insurance is the amount you'd receive if your policy is canceled. We explain how it works, taxes you may owe, and alternatives. The insurance company will then subtract the fees from your total cash value to get the final net cash surrender value. It’s also important to assess any tax implications, as we detail below. An example can explain the tax calculation: Suppose the policyholder x received the cash surrender value of $80,000 after the deduction of 5000 surrender charges.

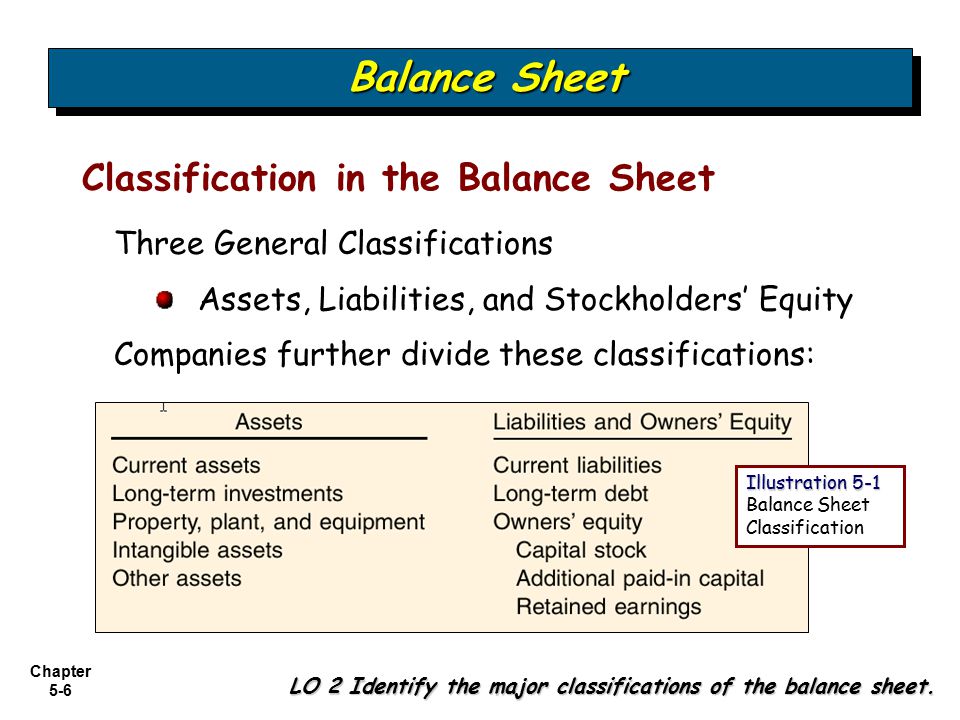

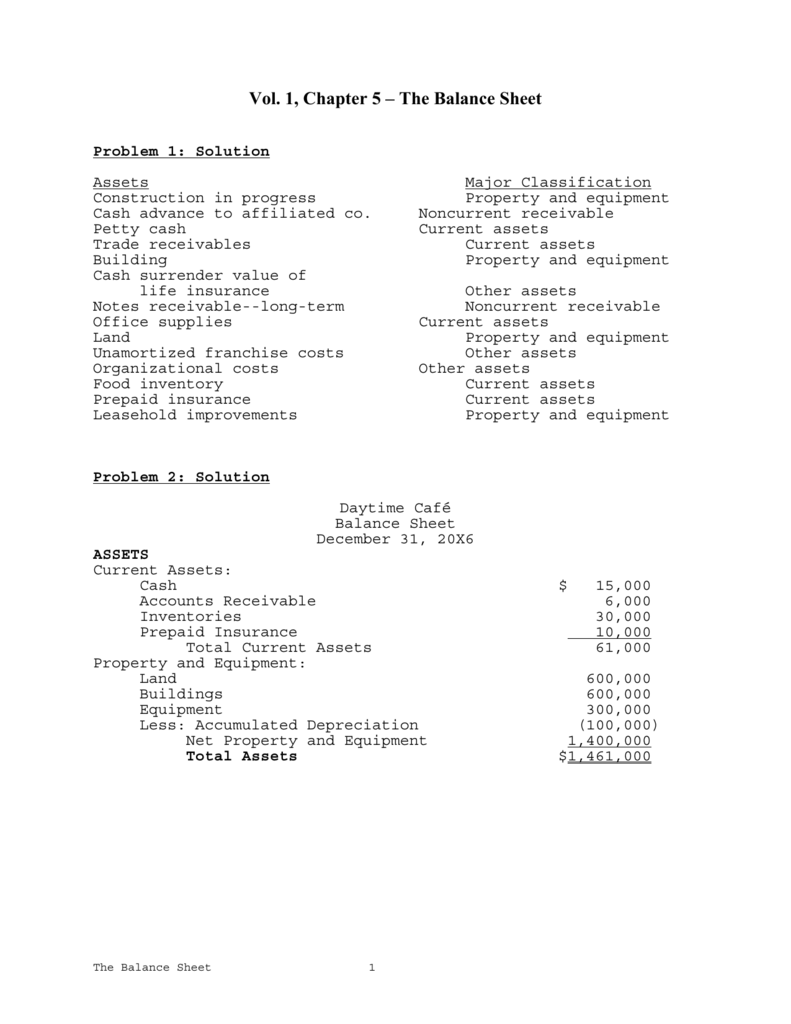

Cash surrender value of life insurance balance sheet - insurance

Should You Get A Whole Life Insurance Policy? We Explain In Details How

Surrender a Universal Life Insurance Policy? | Wealth Management

Cash surrender worth — AccountingTools | Personal Accounting

Cash surrender value — AccountingTools ⋆ Accounting Services

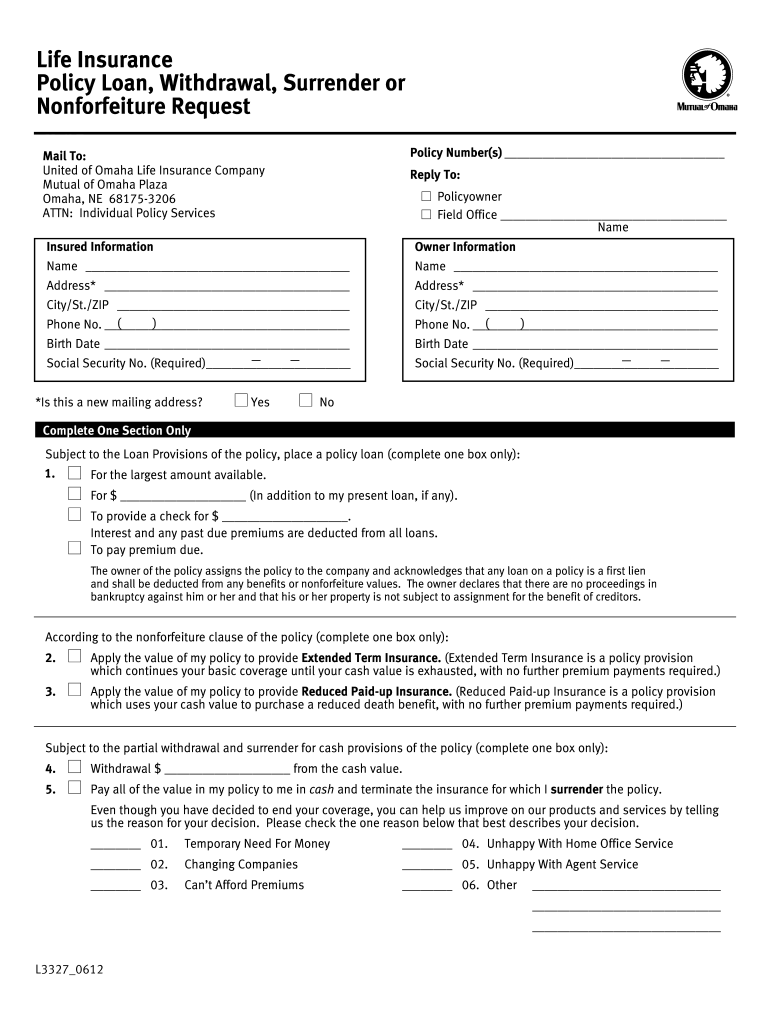

United Of Omaha Life Insurance Cash Surrender Form - Fill Online

How to Calculate Taxable Amount on a 1099-R for Life Insurance

New York Life Insurance Company Reviews: How To Calculate Cash

Cash Surrender Value Of Life Insurance Balance Sheet

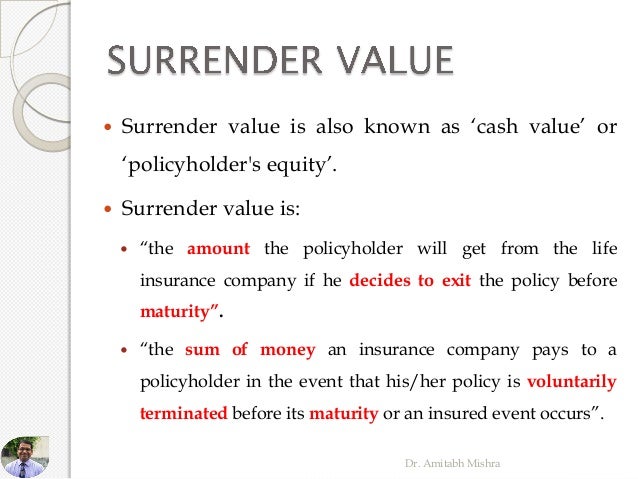

Surrender Value in Life Insurance by Dr. Amitabh Mishra

You Might Also Like:

Life Insurance Contract Types

Life Insurance Policy Locator California

Life Insurance Policy Loan Repayment

Life Insurance Policy Details By Policy Number

Life Insurance Policy Details Wikipedia

Life Insurance Policy Details In Hindi

Life Insurance Quotes Over 60 No Medical Exam

How Much Does Life Insurance Cost Nz

Life Insurance Quotes Go Compare

Lowest Life Insurance Rates For Seniors

Sun Life Insurance Quotes Canada

Universal Life Insurance Quotes Canada

Term Life Insurance Quotes Canada

Life Insurance Quotes 500k

What Insurance Covers Lipo

Aig Lippo Life Insurance Indonesia

Life Insurance Companies By Market Share

China Life Insurance Indonesia Karir

How Much Is The Life Insurance Industry Worth

Alamat Pt Chubb Life Insurance Indonesia Jakarta

Comments

Post a Comment